Highmark Credit Union employees view SDN Communications as one of their team members.

“Anytime we reach out to make a change, a configuration or an upgrade, it’s on a first-name basis,” said Tony Pannone, Highmarks' Chief Information Officer.

It’s a relationship he fostered when he worked at a managed service provider in Rapid City. He had helped sell SDN’s reliability to Highmark. When the credit union's CEO later heard Pannone wanted to work in the private sector, he reached out. Pannone’s served as Highmark’s CIO for six years now and continues to put his faith in SDN.

“Securing our members’ data is made easier because of SDN,” he said.

Highmark was Rapid City’s first credit union when it opened more than 80 years ago. It initially served teachers, with its original location under the stairs in a converted janitor’s closet at the old Rapid City Central High School. The credit union officially renamed as Highmark in 2000 and now serves a much broader membership base.

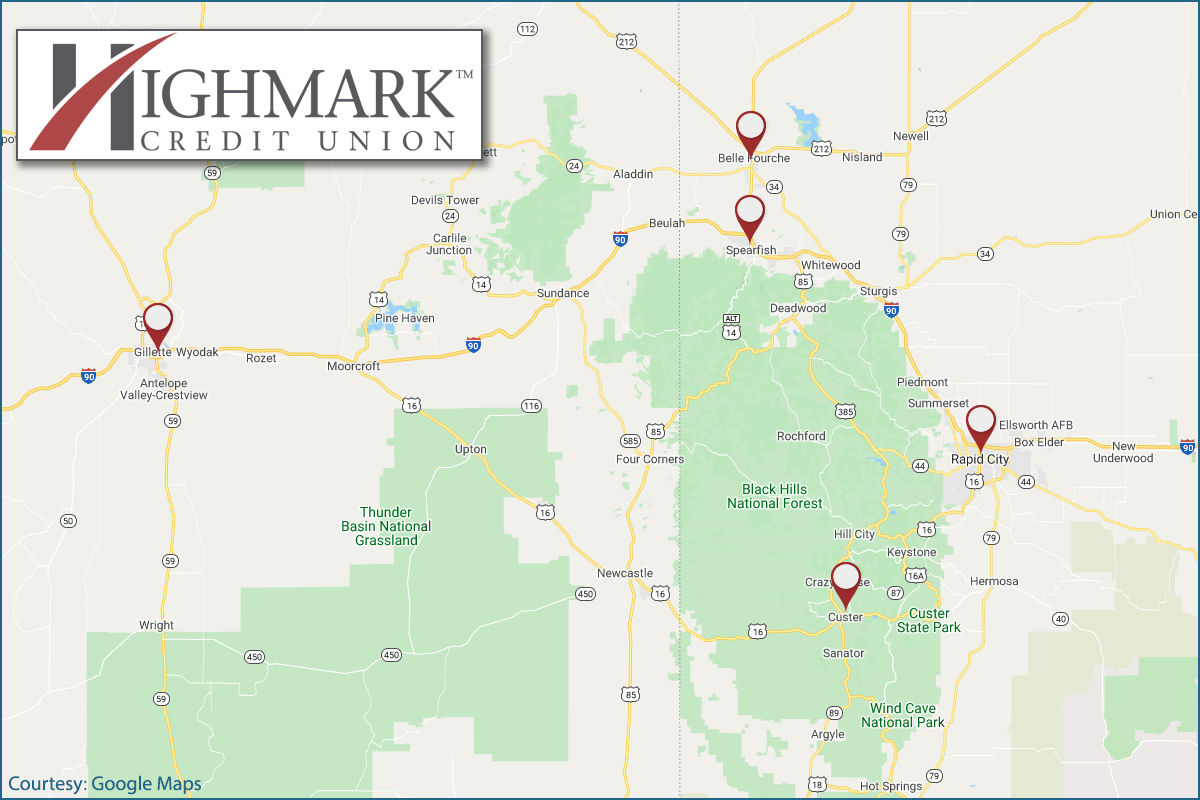

Today, Highmark Credit Union has branches in Rapid City, Custer, Belle Fourche, and Spearfish in western South Dakota and one across the border in Gillette, Wyoming. The busiest branch, however, is the digital one, Pannone said; that’s why reliable connectivity is so important.

“One of the things that really sets SDN apart is our network,” said Greg Robinson, Network Account Executive at SDN. “Our network, our infrastructure is intentionally built to perform so much better.”

Financial transactions are important in the financial sector — without them, banks and credit unions are, well, dead in the water, Robinson said.

“Because of our network, we’re able to assure them that they can serve their customers. The customers can access their accounts, make transactions,” he said. “They know their network is up and that they’re able to function.”

When physical branches closed during the pandemic, it was important that the digital branch remained open for business. Highmark was also in the process of releasing an updated app; it launched March 20, 2020, and the new website followed just days later.

Initially, the credit union had 15 employees working from home as part of the digital branch. One year later, Pannone says twice as many employees are working remotely due to COVID-19. For example, customers often talk with a remote employee over the phone when applying for a loan.

Highmark recently added Geezeo to the app, which is a personal finance manager, similar to Mint, where customers can set financial goals, track spending and more. Instead of connecting accounts to a third party, customers can do all right from the credit union’s app.

“We can easily compete with what the ‘big boys’ do, from remote deposits and other features,” Pannone said. “We brag about our mobile app.”

SDN provides dedicated internet and MPLS for the credit union. Pannone appreciates being able to reach all of the credit union’s physical branches with private connections, which is critical for security and also pays for itself through cost savings.

Highmark is leveraging SDN’s network partners to get the best service to all of its branch locations. They use fiber from SDN, member company Golden West Telecommunications and a member-owned network called Northern Hills Transport in South Dakota as well as Wyoming counterpart Range Communications to reach the Gillette location.

“SDN connects our members with other members, which enables us to have a very robust network,” Robinson said. “For a company that’s regional, that’s a huge benefit to them. They have the assurance of SDN and can reach across the region and beyond South Dakota.”

For Pannone, “Enjoy the UPTIME” is more than a marketing slogan. Like other Highmark employees, he enjoys the family-first culture and the freedom to be creative in finding long-term solutions. He says having a partner like SDN makes that kind of uptime possible.